[ad_1]

You’ve learn all of the books and watched all of the Youtube movies however you continue to don’t know the place to start out. Typically, in relation to your private funds, it may be laborious to use generic recommendation. And that’s most likely why you’re asking the query: do I want a monetary advisor?

Monetary advisors are monetary professionals that information purchasers, utilizing their experience, on what to do with their cash and tips on how to meet their long-term objectives. To supply this, many advisors full particular coaching and maintain skilled certifications.

Perhaps you’re in a little bit of a monetary repair or have dangerous cash habits. Or maybe issues have been going rather well, and also you need your cash to work a bit tougher for you.

Both means, this text will take a deep dive into what it takes to work with monetary advisors. You’ll be taught concerning the various kinds of advisors, what they do, and once you would possibly want them.

Is it actually essential to have a monetary advisor? Tips on how to know

Hiring a monetary advisor could be pricey. So let’s first reply the query, “Do I want a monetary advisor?”.

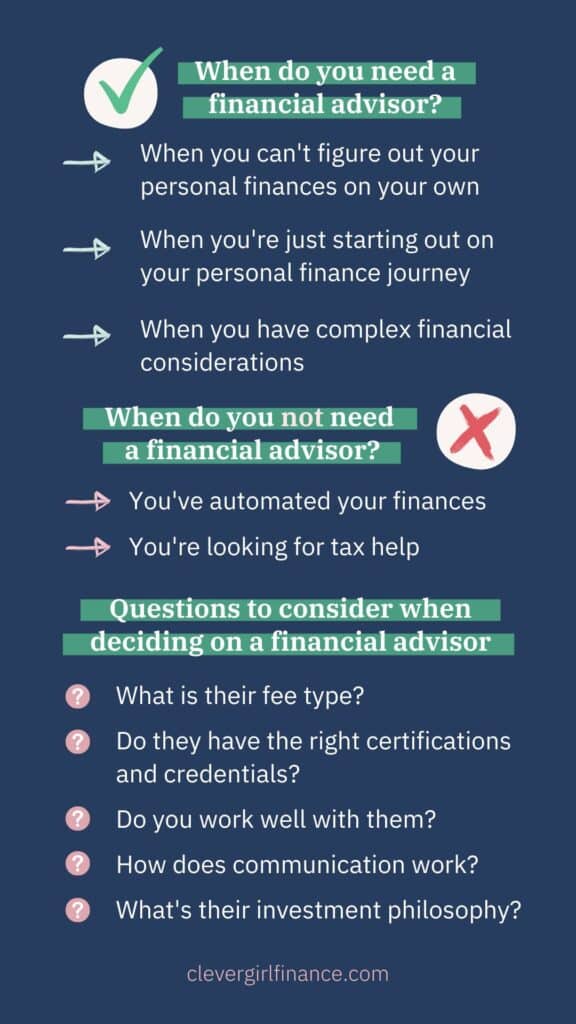

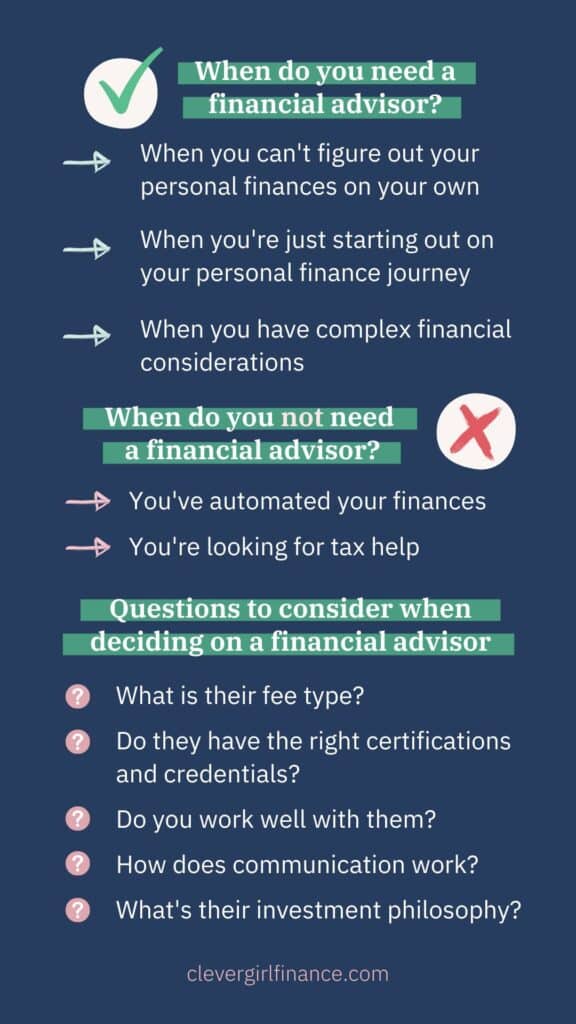

There are some life conditions when it is best to undoubtedly search skilled steering. These embrace the next:

You’ll be able to’t determine your private funds by yourself

For some individuals, managing cash is greater than a chore. You would possibly fall into this class for those who’re already asking the query do I want a monetary advisor? And that’s OK.

All of us have actions the place we shine and others not a lot. Some individuals love cooking, doing dishes, or creating artwork. Others love managing cash.

If you happen to don’t fall into this final bucket, you’re certainly one of many, and hiring a monetary advisor might be a sensible transfer.

While you’re simply beginning out in your private finance journey

If you happen to’re new to understanding tips on how to set intentions to your funds, it may be overwhelming. You’ll be able to be taught concerning the inventory market, bonds, budgeting, retirement planning, and saving. The listing is infinite. So, monetary advisors do assist un-muddy the waters for you.

When must you get a monetary advisor? It’s usually a good suggestion to hunt skilled monetary recommendation as a newbie. Keep in mind, although, that it could possibly value you tons of of {dollars} and extra.

With entry to info on-line, it’s advisable to do your personal monetary analysis first. If you happen to’re nonetheless stumped, then you possibly can take the leap and rent an professional.

You have got complicated monetary concerns

In case your funds aren’t simple, when must you get a monetary advisor? Maybe you’re coping with main life modifications, reminiscent of discovering out tips on how to put together for divorce or bereavement.

In instances like these, exterior counsel might help you navigate cash worries and main life occasions. These can embrace complicated household issues, a number of monetary accounts, or managing money move from a number of sources of earnings.

At any time in your life, whether or not you’re in your 30s, 40s, or past, you will have a main life change, and your funds may look totally different. It might be something from a big pay increase to a brand new child to sudden month-to-month bills.

A monetary advisor can coach you on what steps to take subsequent, regardless of what’s occurring along with your circumstances.

While you obtain a lump sum of cash (reminiscent of an inheritance)

If you happen to’ve acquired a big amount of cash and also you aren’t positive what steps to take, a monetary advisor could be useful. They will information you on financial savings and funding selections and assist you to resolve on some objectives for the cash.

That means, you possibly can make sure that your funds are being dealt with accurately, the best way that you really want, and make a plan so that you don’t spend the cash with out considering.

When don’t you want a monetary advisor?

All cash priorities and circumstances are distinctive. There are cases the place chances are you’ll not want a monetary advisor:

You’ve automated your funds

Have you ever determined to automate your funds so that you’re hitting your financial savings and funding objectives? It sounds such as you’re already in fine condition.

Many individuals on this bucket have arrange a easy funding plan. It should mechanically rebalance with little to no want for making changes. Right here’s an instance of a monetary plan to make sure you are on monitor.

You’re searching for tax assist

Tax assist shouldn’t be confused with monetary advisory assist. Whereas they each take care of your cash, the professionals concerned are fully totally different.

A Licensed Public Accountant (CPA) is finest geared up to help all of your tax wants. A CPA who can be enthusiastic about monetary planning will be capable to contact in your greater monetary image whereas homing in in your taxes.

So if that you must make a tax plan, these professionals will probably be extra useful.

Professional tip

A monetary advisor ought to assist information you in the appropriate path along with your cash. Working with one could be a good suggestion in some instances.

However make sure that you’re making the very best monetary selections for you always, not simply following recommendation. Take time to assume issues via and make sensible decisions, whether or not you’re employed with a monetary advisor or not.

Sorts of monetary advisors

So, do you want a monetary advisor? That can assist you resolve, let’s take a look at the various kinds of advisors to your cash.

Robo advisors

A robo-advisor is also referred to as a digital cash advisor. They supply recommendation based mostly on complicated algorithms linked to your private profile.

A robo-advisor could make automated investments for purchasers, and that is nice when you’ve got a easy portfolio. However remember there’s zero human supervision within the course of.

Robo-advisors work finest for passive investing. And the nice information is you solely want a small opening steadiness to get began. It makes robo-advisors extremely accessible to everybody.

For a extra hands-on strategy, hiring a human monetary advisor is in your finest pursuits. This particular person will turn out to be your go-to monetary useful resource.

As you would possibly count on, although, the hands-on strategy comes at an expense.

Monetary planner (CFP)

A monetary planner will assist you to attain your cash objectives and in addition works with you in your present funds.

A CFP stands for Licensed Monetary Planner (Licensed by the CFP board), which is what it is best to search for for those who resolve to go this route. This particular person should go an examination and full coursework associated to monetary planning, and they’re additionally a fiduciary, which means they put the shopper’s finest curiosity and monetary wants first.

Wealth supervisor

A wealth supervisor can advise you about your cash, and so they sometimes work with rich individuals with excessive internet value. They concentrate on investing, property planning, and different features of wealth.

When you’ve got a big amount of cash or are attempting to develop your wealth, take into account this selection.

Registered consultant

A registered consultant may be a monetary advisor, and they can buy and promote securities for the purchasers they signify. You’ll be able to relaxation assured that they’ve the data that will help you, as they’re required to go intensive exams.

Registered funding advisor

A registered funding advisor can give you steering about your cash. It may be both an individual or an organization, and so they supply assist along with your investing choices.

A registered funding advisor can be held to particular fiduciary requirements, which can provide you with some peace of thoughts. This isn’t a requirement for another varieties of advisors.

What kind of advisory companies do monetary advisors supply?

A monetary advisor serves many functions. However their major purpose is that will help you plan to your future.

They provide steering on how to economize, what monetary accounts it is best to open, or tips on how to construct an funding portfolio if you wish to know tips on how to begin investing correctly. In addition they advise on tips on how to assume via danger, purchase a house, and plan your property (discover out extra with this property planning guidelines).

How a lot does a monetary advisor value?

Your monetary advisor will use a charge mannequin. The choices are often a flat charge, an hourly fee, or a percentage-based charge.

Nevertheless, the charge you pay can even rely upon whether or not your advisor operates in-person or on-line. As you would possibly count on, in-person monetary advisors are typically dearer.

In-person monetary advisors’ charges

When working with an in-person monetary advisor, you’ll come throughout totally different cost choices. Listed here are some frequent ones.

Flat charge

Some advisors cost a flat charge. It will possibly vary wherever from $1,500-$3,000 to make your monetary plan, to a a lot increased quantity.

With this, you’ll get a customized monetary plan constructed to fit your and your loved ones’s wants. It may be helpful as a result of having a plan might help you are taking motion.

Proportion-based charge or fee-only

Some cost a percentage-based charge, which is a share of the quantity you’ve gotten invested.

An instance can be a share of your belongings beneath administration. The share is often about 1%.

Hourly charge

Lastly, in-person advisors could supply an hourly fee that may vary wherever from $200 – $400 per hour. However, with this kind of package deal, you gained’t obtain any follow-up or help. You’ll be by yourself to place the plan into motion.

So, this works finest when you find yourself snug with dealing with your personal funds. And you should have the self-discipline to comply with via.

On-line monetary advisors’ charges

On-line monetary planning provides a decrease charge construction. Charges are based mostly on the belongings beneath administration, i.e. a percentage-based charge construction, and can vary from 0.20% to 0.35%.

There may be sometimes no requirement for big quantities of cash to open such an account.

On-line monetary advisors embrace platforms like Betterment and additionally Wealthfront. These provide you with entry to a private monetary plan and ongoing funding steering.

What to search for in a monetary advisor: 5 Query to ask

In case you are prepared to hunt out a monetary advisor, listed here are some key concerns to remember.

1. What’s their charge kind?

Hiring a monetary advisor can value you tons of, if not hundreds, of {dollars}. So, it’s essential to do a ton of analysis earlier than you decide to a selected advisor. You’ll wish to perceive precisely how the charges will work to your monetary scenario.

Charges could differ by state and stage of service. The important thing to recollect is that the easier your funding wants are, the much less you’ll must pay.

In case you are simply beginning out and want fundamental funding administration, then paying $1,000 for an advisor is lots.

Nevertheless, for those who’re additional together with extra complicated wants, that quantity would possibly make sense.

2. Have they got the appropriate certifications and credentials?

Credentials matter. While you signal on with a brand new advisor, you’re trusting that particular person that will help you construct a safe monetary future.

A monetary advisor must have the appropriate certifications and title, as an example, being a registered funding advisor. You must also search for somebody who’s a fiduciary.

So, the query, on this case, isn’t a lot do I want a monetary advisor, however fairly do I want this monetary advisor?! The correct advisor could have efficiently fulfilled the necessities of the Monetary Business Regulatory Authority (FINRA).

If you happen to’re searching for a monetary planner, you’ll wish to work with somebody who has a Licensed Monetary Planner (CFP) title. This can imply that the person has efficiently fulfilled the CFP Board’s necessities – training, examination, expertise, and ethics – to obtain this designation.

3. Do you’re employed nicely with them?

When coping with any advisor in life, a relationship constructed on belief issues. However in relation to private finance, this issues much more as this might influence your whole future.

As you seek for a monetary advisor, have as many dwell conversations with them as doable. Do your analysis and make sure you belief and might rely upon the particular person totally.

Search for opinions, and for those who can, ask for referrals. The extra aligned you’re in mission, values, and technique along with your advisor, the extra rewarding it will likely be to work with them.

4. How does communication work?

If you happen to’re hiring an in-person monetary advisor, be clear on how a lot entry to them you’ll have.

Will they be obtainable to reply your cellphone calls or reply to your emails rapidly? How ceaselessly will you be capable to meet face-to-face? Be sure that these expectations are set earlier than you signal with them.

5. What’s their funding philosophy?

When you’ve got robust opinions on the influence of your investments, then be sure to select a monetary advisor who aligns along with your values and understands your danger tolerance or how danger averse you’re.

For instance, for those who choose to take a position ethically, then guarantee your advisor is in a position to decide on investments that may use your {dollars} positively.

The place can I discover a monetary advisor?

If you happen to’d choose to take care of an in-person monetary advisor, most often it is smart to decide on somebody native to you. If you happen to’re searching for a good monetary advisor in your space, try the next methods to hunt out an expert you possibly can belief.

Through private referral

Nothing beats the ability of a referral, because it gives reassurance. You’ll know that somebody you belief has obtained nice worth from working with the advisor.

As well as, it provides you first-hand proof that the advisor is dependable and has confirmed success.

However don’t cease there. A referral is just one piece of the puzzle. You’ll wish to ensure that the advisor gives 5-star remedy to everybody he/she encounters.

Be sure you do your analysis, and you’ll even test on-line for complaints filed to FINRA (the monetary regulatory physique).

From on-line opinions

The web has opened up methods for us to make sure checks and balances are in place earlier than signing up for companies. The most important means the web helps is thru opinions.

As you take a look at the profiles of economic advisors, take a look at their private opinions in addition to the opinions of the organizations they’re affiliated with.

If you happen to see any regarding suggestions however are nonetheless notably inquisitive about working with the particular person, you’ll want to ask them about this once you’re interviewing them. You by no means wish to blindly enroll with a cash advisor.

At your native financial institution or monetary establishment

Work along with your native financial institution or monetary establishment for those who’re searching for a vetted monetary advisor. This feature will reassure you that you simply’re coping with a good establishment.

While you work with an advisor out of your native financial institution, you’ll pay customary market charges just like impartial advisors. One other profit is a few advisors supply greater than funding recommendation. They will additionally assist with the significance of life insurance coverage.

Are monetary advisors the identical as funding advisors?

Monetary advisors put on many hats, and so they could focus on totally different areas. Some could name themselves funding advisors.

However, the primary purpose of every advisor is to supply monetary planning companies that assist you to set and meet your monetary objectives.

Monetary advisors additionally help purchasers with steering on investments and retirement accounts like your IRA. They’ll devise plans to help your particular necessities. For instance, faculty financial savings, retirement financial savings, property planning, inheritance, or enterprise funds.

Your advisor may educate you on insurance coverage insurance policies and investments.

Funding advisors, however, are likely to focus on securities.

Keep in mind, anybody can say that they’re a monetary advisor, however you wish to search for somebody who has the credentials {and professional} designations to show they will actually assist you to along with your cash.

How a monetary planner is totally different from a monetary advisor

Each a planner and an advisor might help you along with your cash. However they aren’t precisely the identical.

A monetary planner takes an curiosity within the monetary objectives you wish to accomplish over a few years and helps you arrange a plan to get there.

Alternatively, an advisor can do that as nicely, however they could additionally assist you to with insurance coverage, investments, and so forth. They could focus extra on the investing facet of wealth.

The fundamental variations between the 2 are {that a} planner focuses on assembly your monetary objectives. An advisor is somebody who might help you with this but additionally different features of your monetary well being.

Is it okay to not have a monetary advisor?

Sure it’s okay to not have a monetary advisor – not everybody wants one. In case your funds are automated, or you have already got an incredible cash plan in place, a monetary advisor could also be an pointless expense.

Whereas having an advisor could be useful for some, particularly these with sophisticated monetary conditions, it’s certainly not the appropriate selection for everybody.

Is it higher to have a monetary advisor or do it your self?

In case your monetary scenario is straightforward to handle via automation and/or budgeting, you could possibly deal with your cash by yourself. Particularly for those who perceive monetary literacy fundamentals and investing.

Alternatively, when you’ve got a big sum of cash to take care of, otherwise you’re making an attempt to develop your wealth, and it appears sophisticated, you possibly can profit from the recommendation of an expert.

Do you want a monetary advisor for those who don’t have some huge cash?

It may benefit you to work with a monetary advisor even for those who don’t have some huge cash. You may need a whole lot of questions on cash or are new to managing your funds and an advisor may assist.

Then once more, coping with a smaller amount of cash could also be simpler to handle by your self. You could possibly deal with your funds independently via a finances and fundamental investing abilities.

What varieties of monetary advisors must you keep away from?

In case your advisor is costing some huge cash that you simply don’t really feel is value it, or you’ve gotten considerations that they aren’t placing your finest pursuits first, it is best to keep away from them.

You may additionally select to not work with somebody if one thing simply feels off.

For instance, for those who discover any crimson flags like a scarcity of communication.

Article associated to monetary recommendation

If you happen to preferred this publish about whether or not or to not work with a monetary advisor, try these articles subsequent!

Do you want a monetary advisor? Leverage these tricks to resolve!

If you happen to really feel caught and aren’t positive which approach to go, understanding when must you get a monetary advisor might not be a foul thought.

And for those who’re simply beginning out in your monetary journey and have been asking the query, “Do I want a monetary advisor?” then the probabilities are {that a} skilled could assist to place your thoughts relaxed and assist you to learn to be higher with cash.

However as you achieve extra training and expertise, you’ll step by step really feel extra assured to personal the administration of your funds. Keep in mind, for those who come throughout any bumps within the highway, you possibly can at all times return to your monetary advisor for the newest recommendation that will help you attain your cash objectives.

[ad_2]

Supply hyperlink